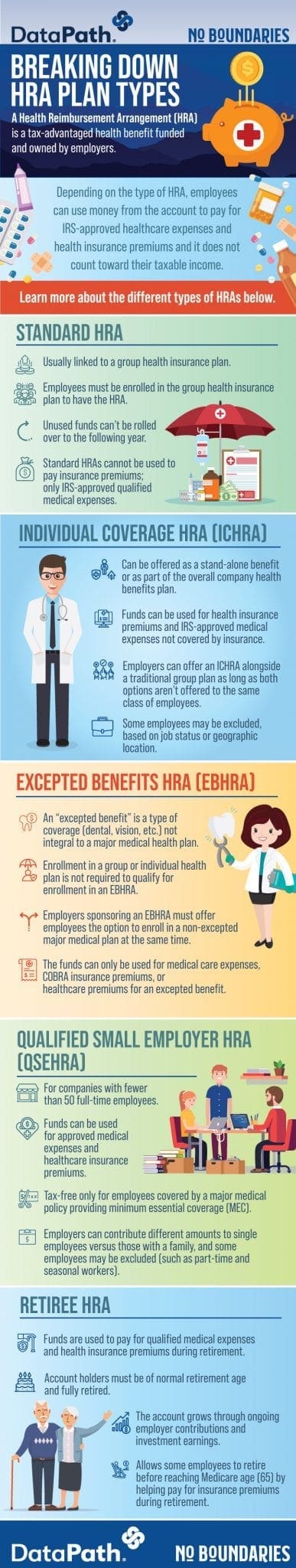

A Health Reimbursement Arrangement (HRA) is a tax-advantaged health benefit provided by employers. Employees can use money from their HRA to pay for IRS-approved healthcare expenses and health insurance premiums, and it does not go against their taxable income.

Standard HRA

Usually coupled with a group health insurance plan.

Employees must enroll in the group health insurance plan to get the HRA.

Unused monies cannot be rolled over into the following year.

Standard HRAs cannot be used to pay insurance premiums; only IRS-approved eligible medical costs.

Individual Coverage HRAs (ICHRA)

Can be provided as a standalone benefit or as part of the overall employer health benefits plan.

The funds can be used for health insurance premiums and IRS-approved medical expenses that are not covered by insurance.

Employers can offer an ICHRA in addition to a standard group plan, as long as both alternatives are not offered to the same class of employees.

Some employees may be excluded, depending on their job status or geographic location.

Infographic Source: https://dpath.com/hra-plan-types-infographic/

Leave a Reply