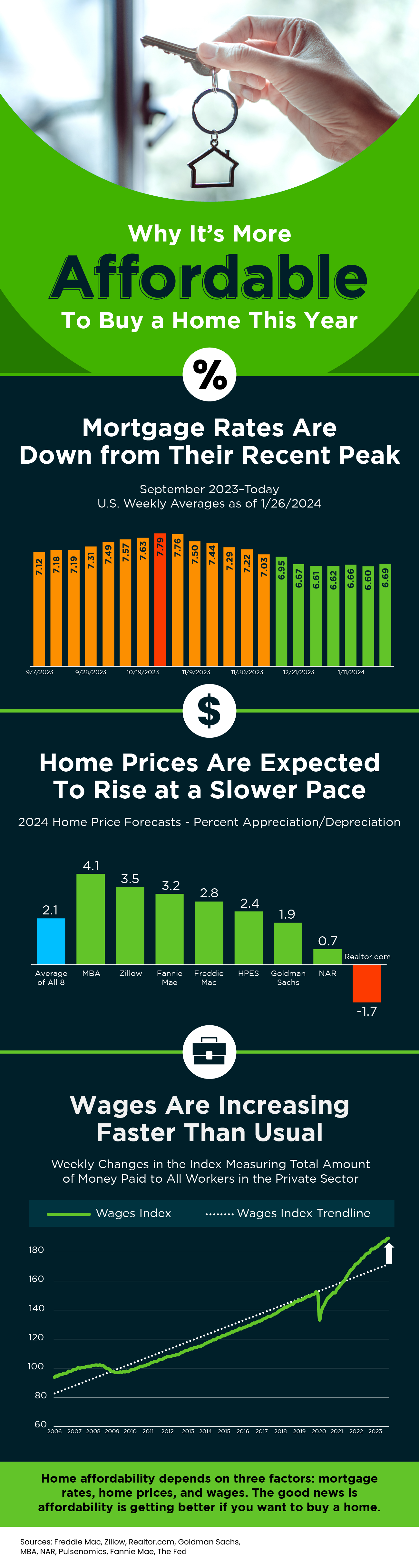

The combination of lower mortgage rates, a more subdued increase in home prices, and faster wage growth can indeed create a more favorable environment for potential homebuyers. Let’s break down how each of these factors contributes to the improved conditions:

1. Lower Mortgage Rates: When mortgage rates are down, it means that borrowers can secure loans at a lower cost. This reduces the monthly mortgage payments, making homeownership more affordable for buyers. Lower rates can also stimulate housing demand.

2. Slower Pace of Home Price Growth: If home prices are expected to rise at a slower pace, it means that the rate at which property values increase is more moderate. This can be advantageous for buyers as they may be able to find homes at relatively stable or more reasonable prices, avoiding rapid inflation in the housing market.

3. Faster Wage Growth: When wages are increasing faster than usual, it provides potential homebuyers with more financial capacity to afford homes. Higher incomes mean that individuals and families have a greater ability to meet mortgage payments and associated housing costs.

These factors collectively contribute to improved housing affordability, potentially encouraging more people to enter the real estate market. However, it’s crucial for buyers to consider other factors such as local market conditions, their personal financial situations, and any potential changes in economic conditions that could impact the real estate market.

It’s also important to note that the real estate market can be dynamic, and conditions can vary based on location and other external factors. As always, potential homebuyers should conduct thorough research, seek professional advice, and carefully assess their own financial readiness before making significant decisions about homeownership.

Leave a Reply